What is a PAMM account?

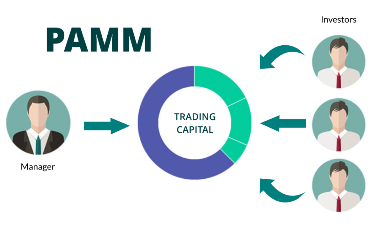

PAMM stands for "Percentage Allocated Money Manager", this type of trading account allows investors to allocate funds to account managers, which can then be traded from a main account.

The PAMM system is mainly used in the forex market, and provides investors with the opportunity to profit from trading without having to perform technical analysis or initiate trades themselves.

However, the forex is not the only sector that can be traded using PAMM accounts. Brokers such as FxOpen offer PAMM accounts for cryptocurrency trading as well.

How do PAMM accounts work?

PAMM is the name given to the technology that allows fund managers to trade funds pooled from different accounts, called sub-accounts. A fund manager advertises their services, including their performance history, as well as account terms, such as any commission, which will be charged if the trade is profitable. The fund manager also invests his own funds in the account, which gives him more incentive to trade responsibly.

Investors sign a "limited power of attorney" (LOPA), ie they agree to assume the transaction risk until the end of the mandate. At the end of the term, investors can choose to cash out, continue to invest with the fund manager, or transfer their funds to another provider.

Forex PAMM accounts are opened through trading websites, which provide transparency and security to the investor if he chooses a well-regulated broker. However, this does not provide protection against losses that might be incurred by the account manager's trading decisions.

MAM vs PAMM accounts

Brokers with PAMM accounts allocate profits or losses among investors based on their initial deposit, minus commission fees. Multi-account management (MAM) is a flexible derivative of the PAMM account which allows transactions to be distributed in a non-proportional manner. This means that some investors may choose to take more risk, for example by using leverage, which results in different returns for investors using the same fund manager.

Benefits of PAMM accounts

There are several benefits to choosing a broker that offers PAMM accounts:

- PAMM accounts allow investors to profit from trading without having to monitor the markets or perform analyses themselves.

- Trades can easily be executed on a single system, without complicated bookkeeping, when using funds from different sources.

- The fund manager will often be experienced in trading which increases the likelihood of generating a profitable return.

- The account manager must invest his own funds in the account and only receives a commission when a trade is profitable, which encourages him to trade to the best of his ability.

- Investors can choose from a wide variety of fund managers and can divide their funds among multiple fund managers in order to diversify their portfolio.

- Brokers act as guarantors, preventing the fund manager from withdrawing funds, and also act as an independent body to provide statistics and historical performance of the various PAMM accounts.

Risks associated with PAMM accounts

There are also a few drawbacks associated with PAMM accounts:

- As in all trading, there is a risk of loss of capital, which depends here on the decisions made by the money manager and cannot be influenced by the investor.

- Often there is not enough information available to study a fund manager's trading strategy in detail.

What you should look for in a PAMM broker

Here, we will list the items to take into account when choosing a PAMM brokers with which to open an account.

Account requirements

Forex accounts managed by PAMM are often subject to conditions such as minimum deposit requirements and limits on the number of trading accounts.

Some brokers offering PAMM forex accounts also have base currency requirements for the account.

Software

Although it is the account manager who trades, having top quality tools increases the likelihood that he will execute a successful trade. FXOpen is an example of a broker that offers three types of PAMM accounts: STP, ECN, and Crypto, each of which features various leverage and commission options.

Check the underlying software and platform offered by the broker, which will determine the types of orders available as well as the trade process and its speed of execution.

Other important features include the ability to monitor trading performance in real time. Risk management is also essential in trading, so look for accounts that allow you to set stop-loss orders.

Fund manager

Ultimately, the fund manager carrying out trades has the greatest influence on profits and losses. Examine the manager's forex strategy, past performance, commission fees and rating to determine which account to invest in. Also consider the age of the account, as older accounts with good performance are more credible.

A final word on brokers with PAMM accounts

PAMM accounts enable the direct execution of trades using funds from different accounts, allowing fund managers to conduct forexe trades on behalf of multiple investors. This offers several benefits, including the ability for investors to make money without having to monitor the markets and perform technical analysis on their own. However, PAMM accounts are exposed to the same risks as individual trades, which means that risk management remains essential.

FAQs

What is a PAMM account?

A PAMM account is mainly used in forex trading and allows investors to allocate capital to fund managers, who trade these funds from a main account. This allows investors to profit from trading, without having to perform technical market analysis or execute trades themselves.

What is a PAMM broker?

A PAMM broker offers investors and fund managers the option of opening a real account to facilitate trades. When properly regulated, the broker provides security and acts as an independent body that posts the past performance of its fund managers.

Which brokers offer PAMM accounts?

The following are the most popular brokers offering PAMM accounts: FxOpen, HF Markets, and Admiral.

How do I become a PAMM account manager?

To open a PAMM account, register with a broker, log in and make an initial deposit to your main account. Some brokers will have additional requirements such as a minimum number of investors in a pool before they can start trading.