You are not logged in.

#1 20-11-2014 11:09:35

- johnedward

- Admin & Trader

- From: Paris - France

- Registered: 21-12-2009

- Posts: 3601

- Website

5 banks heavily fined by CFTC/FCA/FINMA in forex manipulation scandal

5 banks heavily fined by CFTC, FCA, FINMA in forex manipulation scandal

Article by forexmagnats

In a Coordinated Blitz, Regulators Bombard Top Banks for Systemic Collusion in the Forex Market

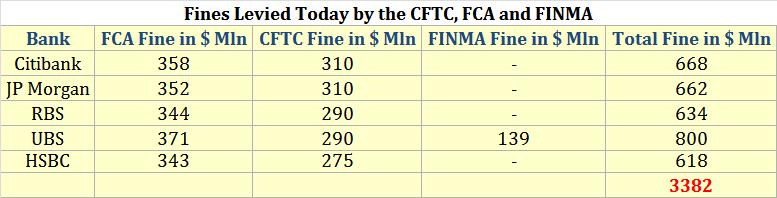

After long-running, multilateral investigations regulators on both sides of the Atlantic pounce into action by blitzing five banks with fines collectively exceeding $3.3 billion.

Regulators in the US, UK and Switzerland today imposed multi-billion dollar fines on five banks in conclusion of the highly publicized Forex manipulation investigations that have been ongoing over the past 12 months.

One of the primary benchmarks that the forex traders attempted to manipulate was the World Markets/Reuters Closing Spot Rates (WM/R Rates). All the announcements made today refer to how banks colluded in this core benchmark used to price cross-currency swaps, foreign exchange swaps, spot transactions, forwards, options, futures and other financial derivative instruments.

(US) – The U.S. Commodity Futures Trading Commission (CFTC)

The CFTC ordered five banks to pay over $1.4 billion in penalties for manipulation of Foreign Exchange Benchmark Rates between 2009 and 2012.

The five banks facing fines for “attempted manipulation of, and for aiding and abetting other banks’ attempts to manipulate, global foreign exchange (forex) benchmark rates to benefit the positions of certain traders.” The penalized banks are Citibank, HSBC, JP Morgan, Royal Bank of Scotland (RBS) and UBS. The fines collectively impose over $1.4 billion in civil monetary penalties, specifically: $310 million each for Citibank and JPMorgan, $290 million each for RBS and UBS, and $275 million for HSBC.

Additional to the fines are stipulations made by the CFTC: “The Orders also require the Banks to cease and desist from further violations, and take specified steps to implement and strengthen their internal controls and procedures, including the supervision of their forex traders.”

In a de facto admission that banks used benchmark rates simply to earn a profit, Aitan Goelman, the CFTC’s Director of Enforcement said: “The setting of a benchmark rate is not simply another opportunity for banks to earn a profit. Countless individuals and companies around the world rely on these rates to settle financial contracts, and this reliance is premised on faith in the fundamental integrity of these benchmarks.”

The CFTC cites how “banks failed to adequately assess the risks associated with their forex traders participating in the fixing of certain forex benchmark rates and lacked adequate internal controls in order to prevent improper communications by traders.”

(UK) – Financial Conduct Authority (FCA)

In a strikingly similar vein, the UK’s FCA today broadly imposed similar sized fines to precisely the same banks as the CFTC. The coordinated investigation that has taken months to conclude, finally yielded outcomes on both sides of the Atlantic.

The five banks facing fines for “failing to control business practises” in their spot forex trading operations are: Citibank, HSBC, JP Morgan, Royal Bank of Scotland (RBS) and UBS.

In a statement, the FCA said, “The failings at these Banks undermine confidence in the UK financial system and put its integrity at risk.” Furthermore, the FCA intends on “launching an industry-wide remediation programme to ensure firms address the root causes of these failings and drive up standards across the market.”

Martin Wheatley, Chief Executive of the FCA, said: “Today’s record fines mark the gravity of the failings we found and firms need to take responsibility for putting it right. They must make sure their traders do not game the system to boost profits or leave the ethics of their conduct to compliance to worry about. Senior management commitments to change need to become a reality in every area of their business.”

Tracey McDermott, the FCA’s Director of Enforcement and Financial Crime, said: “Firms could have been in no doubt, especially after Libor, that failing to take steps to tackle the consequences of a free for all culture on their trading floors was unacceptable. This is not about having armies of compliance staff ticking boxes. It is about firms understanding, and managing, the risks their conduct might pose to markets.”

Attentive readers would have noticed the absence of Barclays from the above list of scolded banks. This is because the FCA is applying specific focus and concentration on Barclays… “We will progress our investigation into that firm [Barclays] which will cover its G10 spot forex trading business and also wider FX business areas.”

(Switzerland) – Swiss Financial Market Supervisory Authority (FINMA)

The worst hit bank from today’s synchronized regulatory backlash is UBS, reaping in excess of $800 million in fines. The Swiss giant is the only bank to be fined by three separate regulators in three different countries in a single day. Possibly some sort of record although in current markets, a record that may not last long.

FINMA found that over an extended period of time the bank’s employees in Zurich attempted to manipulate foreign exchange benchmarks. In addition, employees acted against the interests of their clients. For these indiscretions, FINMA fined UBS 134 million Swiss francs in confiscation of costs avoided and profits.

FINMA investigated three other Swiss banks regarding misconduct in foreign exchange trading but the regulator said, “Shortcomings that emerged there can be remedied by corrective supervisory measures without requiring enforcement.” Adding, “FINMA’s investigations are thus concluded.”

In its multilateral investigations, FINMA found serious misconduct of employees in foreign exchange trading and in precious metals trading. Specifically, FINMA identified the following indiscretions: actively triggered client stop-loss orders to the advantage of the bank

actively triggered client stop-loss orders to the advantage of the bank engaged in front-running

engaged in front-running engaged in risk-free speculation at the clients’ expense when making partial fills, where at least part of clients’ profitable foreign exchange transactions were credited to the bank

engaged in risk-free speculation at the clients’ expense when making partial fills, where at least part of clients’ profitable foreign exchange transactions were credited to the bank disclosed confidential client identifying information to third parties

disclosed confidential client identifying information to third parties in individual cases engaged in deception regarding sales mark ups and excessive mark ups associated with an internal product of the bank.

in individual cases engaged in deception regarding sales mark ups and excessive mark ups associated with an internal product of the bank.

FINMA has initiated enforcement proceedings to determine the knowledge and conduct of persons involved, up to the highest level of the Investment Bank’s foreign exchange business. This concerns eleven of the bank’s former and current employees.

"Anything worth having is worth going for - all the way." - J.R. Ewing

Offline