You are not logged in.

Pages: 1

- Index

- » Analyses / Forecasts (by major banks and brokers)

- » USD: the currency markets are being flooded with dollars

#1 27-11-2020 13:50:17

- johnedward

- Admin & Trader

- From: Paris - France

- Registered: 21-12-2009

- Posts: 3600

- Website

USD: the currency markets are being flooded with dollars

USD: the currency markets are being flooded with dollars

One of the major themes of this year's crisis is the USD's weakness. The weakness of the greenback is attributed to gold, which has reached a new record high, equities which have done the same, and the strong trend of the G10 currencies.

Make no mistake, other central banks have also experienced a slowdown. In fact, some have not even stopped relaxing. Think of the European Central Bank (ECB). It has kept the deposit facility rate below zero for several years. In the meantime, it has put in place various easing programmes, such as TLROs (Targeted Long-Term Refinancing Operations) long before the economic downturn related to the virus. It did so because economic growth in the euro zone was anaemic. It still is.

However, the fact that the ECB and other central banks (e.g. the Bank of England) have continued to ease in recent years has not affected the strength of their currencies. While the Fed stopped printing presses for a few years and even raised rates above 1.9%, others did not.

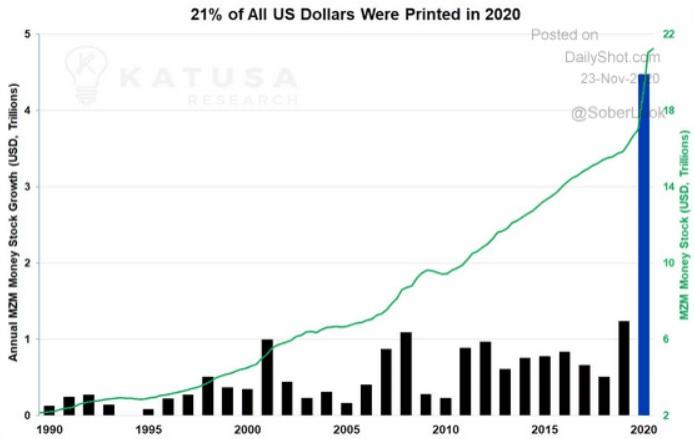

And then the virus hit. Everyone else relaxed again. However, when the Fed started to relax, it overtook everyone else and regained the ground it had lost in recent years. Around 21% (!) of all the dollars ever created were printed THIS YEAR! Take a moment to let that sink in!!

The foreign exchange market before the end of the year

With the Fed literally printing more than anyone else, the was set for the dollar's decline. And it declined. From the moment the Fed began to relax, the USD literally collapsed against the G10 currencies while strengthening against emerging market currencies.

In other words, it made life miserable for everyone. On the one hand, the G10 central banks would like to have a weaker currency to fight the crisis. Consider the ECB, which went so far as to intervene verbally against the higher EUR/USD rate. It did so when the EUR/USD reached 1.20 in the summer. Where does the pair stand at the end of November? You guessed it: close to 1.20, with trading at 1.1935 at the time of writing.

On the other hand, emerging markets are suffering even more. The dollar is the preferred currency for issuing bonds, as it is easier to find clients for USD-denominated bonds. But this works very well in times of economic expansion and backfires in times of recession. This year, emerging markets have seen their currencies depreciate (for example, the TRY - the Turkish lira - continues to reach historically low levels against the USD), while at the same time they have to service their USD debt. Once again, the US is a winner.

Whether or not ownership of the global reserve currency is a privilege or not remains controversial.

"Anything worth having is worth going for - all the way." - J.R. Ewing

Offline

Pages: 1

- Index

- » Analyses / Forecasts (by major banks and brokers)

- » USD: the currency markets are being flooded with dollars