The Commitment of Forex Traders - COT report

The Commitment of Traders report is a disclosure of the net long and short positions taken by both speculative and commercial traders. It's a terrific resource that lets you see how the market's big players are positioned in the market. Forex-Central already lets you see what individual traders are positioned on, but do you want to follow the herd, knowing that most of the herd is losing money?! Probably not! The COT (Commitment of Traders) report is actually a report on currency futures positions that are taken by institutional players: commercial traders (companies and banks that are hedging to protect themselves from adverse currency swings) and non-commercial traders (speculators who are only looking to make profits, such as fund managers, financial institutions and individual traders just like you!).

Why is the COT report useful?

First of all, if you're a scalper or a day trader, you had best look at other forex trading strategies, this one is for longer term forex traders (who hold onto positions for weeks or months)! The COT report is useful for long-term traders as it helps you identify extreme net long or net short positions. And when you see such extreme positions, it usually means that a market reversal is just around the corner because if everyone is long a currency, who is left to buy? Nobody! And the same reasoning applies to short positions.

Where do I find the COT report?

The COT report is published every Friday at 20:30 PM (GMT) and features a snapshot of the previous Tuesday's activity. You can find it here on the: U.S. Commodity Futures Trading Commision (CFTC) webpage. Just scroll down to the "CURRENT LEGACY REPORTS" section and click on "Short Format" or click on the below picture...

...to get the actual report:

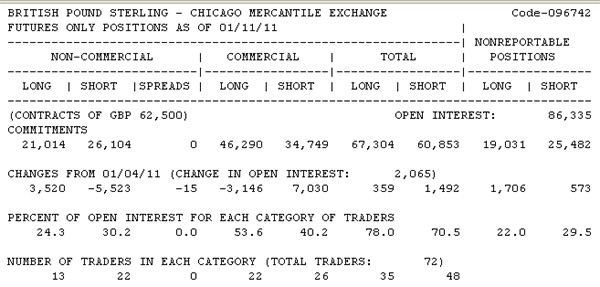

Example of the Chicago Mercantile Exchange report

As you can see, you have your Non-Commercial positions in the left columns, followed by the Commercial positions. Here you can see the number of long positions (in the above picture, each long or short position is for a contract worth 62,500 British pounds).

The "open interest" number is the total number of open contracts (purchases and sales) made by all types of traders.

On the second line you see the changes from last week (this is great for seeing whether fund managers and hedgers are adding to their positions or easing off).

On the last line you see the number of traders holding these positions. These are traders whose positions are large enough that they have to report them to the CFTC. The last columns on the right represent the positions by traders who are not required to disclose their positions to the CFTC (because they're not large enough).

![]() Click here to see the latest Chicago Mercantile Exchange report

Click here to see the latest Chicago Mercantile Exchange report

How do I interpret this data?

You have to keep in mind what characterises the two groups of traders that hold the futures positions listed in that report. Because they are hedging (to protect themselves from a currency devaluation for example), the commercial traders are the most bullish at market bottoms and the most bearish at market peaks. On the other hand, the non-commercial traders, or speculators, are dedicated to following the trend, selling when the market is heading downward and buying when the market is going up. They keep adding to their positions until the price trend reverses. Their strategy often involves following moving averages.

Let's look at a visual example to understand all of this:

See the COT report chart

Above us, we have a weekly chart of the EUR/USD pair. The two most important lines at the bottom are the blue one (commercial traders which are hedging to protect themselves) and the green one (non-commercial traders that are trying to profit by following the trend). Notice how they seem to mirror each other!

From this chart we can see that non-commercial short positions hit an extreme low in Sept 2008; 2 months later, the EUR/USD pair reversed and went up, as there was seemingly no one left to sell. Conversely, non-commercial long positions hit an extreme high in October 2009; and again, 2 months later the EUR/USD pair reversed and started falling, as there was apparently no one left who wanted to buy. There is an apparent 1 to 2 month lag between extremes on non-commercial traders' positions and the reversals of price.

If you had recognised that the non-commercial speculators' short positions were at an extreme low in September 2008, and you had bought at the 1.26 level and sold when their long positions were at an extreme high in October 2009, you would have made 2400 pips! Just the same, if you had recognised that the non-commercial speculators' long positions were at an extreme high in October 2009, and you had gone short at the 1.48 level and sold when their short positions were at an extreme low in March 2010, you would have made another 1200 pips! 2 transactions worth a profit of 3,600 pips ...not bad, eh?!

Of course, it's hard to tell exactly when you've hit the actual extreme, so it's sometimes best to not do anything until the actual market reversal has been confirmed.

As you can see, this is a great strategy for the long-term trader who is not in a hurry but wants to capture the full big moves of the market. Unfortunately, even though the COT report is free, it is only provided on a weekly basis, you would have to record the data yourself in an Excel spreadsheet to track the movements of non-commercial traders' long and short positions. However, since you only need those 2 numbers each week, this would only take one minute of your time each week - a small price to pay for all of those pips you can capture.

Once again here are the links that you need to get this Commitments of Traders data:

![]() The U.S. Commodity Futures Trading Commision (CFTC) webpage

The U.S. Commodity Futures Trading Commision (CFTC) webpage

![]() The Commitments of Traders report

The Commitments of Traders report

![]() A very interesting article on the COT Report in which you will find a free Expert Advisor to see the COT report directly in MetaTrader 4.

A very interesting article on the COT Report in which you will find a free Expert Advisor to see the COT report directly in MetaTrader 4.