Options trading

The power of vanilla options lies in their versatility. They allow a trader to adapt or adjust his positions in the financial markets according to the current situation.

Binary options have the advantage of reducing the emotional aspect of trading and being easy to understand. However, they can appear to be nothing more than basic, highly speculative bets.

Options are complex derivative instruments, some options trading strategies may be conservative while others may be speculative in nature, with a substantial risk of loss.

Whether they are used to hedge foreign exchange risks or to speculate, most multinationals and trading professionals use options in one shape or another.

The following sections present the basic principles of binary and vanilla options trading. Keep in mind that most options traders have many years of experience, you cannot become an expert immediately after reading these articles.

Recommended options broker

How options work

| Quadruple witching day The quadruple witching days are the quarterly expiration days of four derivative products: options on indices, stock options, futures on indices and stock futures. |

| Option expiration calendar Some options expire on the third Friday of each month (these are known as Triple witching Fridays). These Fridays are usually quite volatile, especially at the end of the quarter (Quadruple witching days). |

Options trading strategies

|

Options trading strategies The various options trading strategies you can use to hedge a stock portfolio or invest in neutral, bearish or bullish markets. |

The various types of options

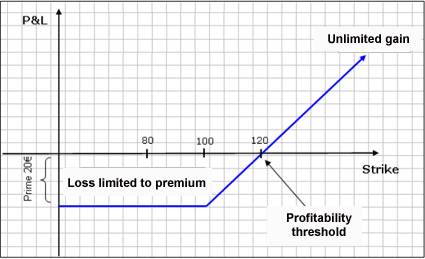

| Vanilla options This article discusses how standard "call and put" options work. They are also called vanilla options, and they have been available on the major exchanges since 1973. |

| Binary options Binary options are known for their ease of use. The trader bets on the ending price of a currency pair or a stock at the end a predefined period of time. |

| The difference between forex trading and binary options Although binary options are easy to use, this doesn't mean that they're ideal for beginning traders, they're actually better suited to those with a bit of trading experience. |

Derivative products: warrants, turbos, swaps

| Warrants and call options (options to buy) Warrants and call options are securities that provide their holders with the right - not the obligation - to purchase a share at a fixed price over a predetermined period of time. What are the differences between these 2 trading instruments? |