Bank trading strategy: how to enter a trade

On the previous page, we discussed the importance of learning the trading strategy banks use (Smart Money) and the basics of the 3 key steps. Now let's see the implementation of this strategy in the real market. We will examine the GBP/JPY pair in the below example.

The chart below represents GBP/JPY in June and July 2020. During this period, banks were accumulating a position. Notice how the price moved within a range. This is because banks had entered the market over time to avoid driving the market higher. By doing so, the banks managed to maintain relatively stable price action.

The manipulation phase ran from late July to August 2020. In the next chart, we see a fake push at the end of the manipulation phase. But in reality, there was no economic news to support the continued price climb. In any case, an understanding of fundamental analysis is key for this strategy.

In this phase, the banks manipulated the market by creating buying pressure as they built up a short position. Although the price rose, it was only momentary as the banks planned to push a downtrend.

Once the manipulation phase was over, the banks started pushing the market lower. This is where retail traders like us can benefit. We can enter a short position immediately after the short-term uptrend ends.

How can I trade like the banks?

For regular traders like you, this strategy can be quite difficult to grasp. Most existing strategies are reactive, which means they react to price shifts and produce a buy or sell signal accordingly.

Banks are well aware of this situation. As market makers, they exploit our reliance on reactive strategies. So when the market pushes retail traders to buy or sell, it is actually the banks that are leading them to do so.

Retail traders who don't know this are always at risk of being tricked. This is why it's very important that you be aware of the different types of strategies. For example, the banks' trading strategy is predictive in nature. Instead of reacting to price action, the premise of this strategy is to predict the next market trend.

It goes without saying that you'll need time to master this strategy. If you're new to this, you can follow the following approaches to increase your odds of success.

Trade using longer timespans

Banks don't engage in short-term trading. They don't trade on 5-minute charts. Remember, they accumulate position over several hours or even days. Needless to say, the banks trading strategy is not designed for day traders. If you day trade, you'll need to turn into a position trader who holds positions for weeks or months.

Using fundamental analysis

This approach involves analysing macroeconomic data, news reports and sociopolitical factors that may affect forex prices. This may sound complicated, especially if your specialty is technical analysis. Understanding fundamentals will allow you to identify supply and demand areas, so that you can identify the direction a currency pair will head towards.

In other words, the banks' trading strategy doesn't involve fancy technical indicators, which can sometimes be confusing. The only technical tool you need is the chart that shows price levels. However, you can also use simple technical tools to help identify a false breakout. After all, no trader wants to be manipulated by banks.

Monitor prices during the distribution phase

If you have successfully tracked the banks' accumulation and manipulation phases and are now at the distribution phase, you can start taking profits. Let's say the market is in an uptrend, so you follow the trend by buying. This is obviously the right thing to do, but you should be aware of one important detail: banks are experts at contrarian trading.

They buy when retail traders sell, and sell when retail traders buy. What they are doing is accumulating a position that will eventually start a trend in the opposite direction. You should therefore watch the price carefully in the distribution stage, as this may be the phase when the bank starts accumulating again.

Understanding how banks trade currency pairs is an excellent basis for your trading strategy. Banks most likely win trades because of their financial power that allows them to control the market. The banks' trading strategy is designed for retail traders to follow the banks' trading activity, so that they can follow the trend they create. We can identify where banks are accumulating a position, how they are manipulating the market, and what market trend they are trying to push. This may sound easy, but it takes time to master this strategy and earn consistent profits. Remember to try the strategy with a demo account before using it on a real account with real funds.

The banks' trading strategy is designed to help retail traders enter the market at the right position, where they can avoid being trapped by the banks' accumulation and manipulation phases. To enhance this strategy, you can also monitor bank trading positions using a certain trading tool.

Do you want to know what banks' positions are? This premium tool will help you:

Do you know who the forex market players are? Most players are retail traders like you and me. However, most of the money is being traded by governments, central banks and international banks. Knowing where and when they will move would be very useful to us.

Government and central bank moves are usually announced publicly. But what about info on the forex trading positions of big banks? Even the best brokers aren't usually able to provide this kind of information.

In the past, we had to open an account with each major bank in order to receive their newsletters. Technology has come a long way since then, and we can now access information on major banks' forex positions from the comfort of our living room by visiting efxdata.com.

What is eFXdata?

eFXdata started out as a Dow Jones news service and then morphed into a premium newsfeed offering key insight into big banks' thinking on the macroeconomic landscape and developing currency trends. The Massachusetts-based fintech company is led by a team of economists, data analysts and developers.

In 2015, it launched eFXplus, which aggregates sell-side research insight on 27 currency pairs from the currency trading desks of Goldman Sachs, Societe Generale, Merrill Lynch, Morgan Stanley, Commerzbank, Credit Suisse, Citibank, Barclays, JP Morgan Chase and many more. The browser-based service displayed lists of major banks' forex position changes, with desktop and email alerts for premium subscribers.

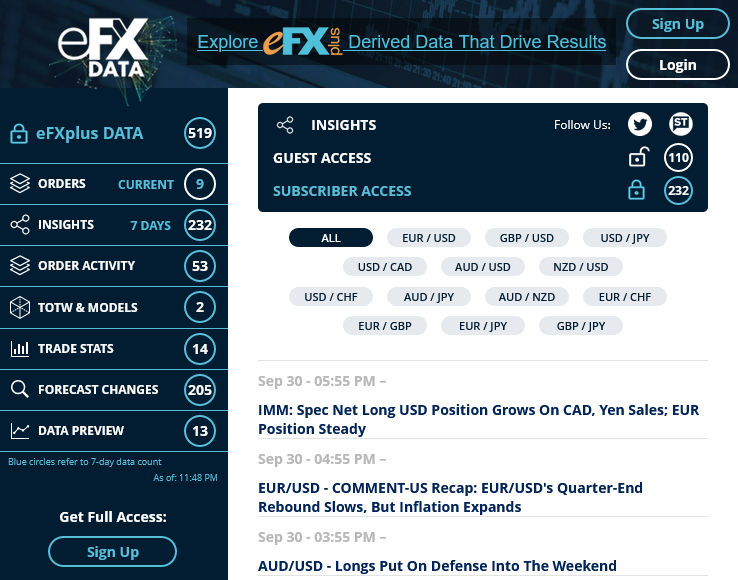

You can also use the online service for free (without automatic refreshes or personalised notifications/alerts). See the below screenshot for an idea of the information you'll get.

Don't forget that free users can't access all of eFXdata's services. What you see above is a glance at what free users can see. But even this can give you insight into how the big banks will buy or sell certain currency pairs, and at what levels.

The basic subscription to eFXPlus's premium newsfeed starts at $100 per month (a 7-day trial is available for $20) for full online access, automatic real-time refreshes, and alerts. You can also sign up for the premium plan at $130 per month or $1,200 per year to get all the basic features plus instant, daily email notifications.

Do I really need to know what banks' currency pair positions are?

Regarding eFXdata, you might be tempted to sign right up for the premium service. However, we must warn you that it might not be right for you. Think it over before you whip out your credit card!

One of the key factors to successfully trade currencies is good market timing: the ability to identify continuing trends, reversals as well as bounces before they happen. It is also the ability to identify where market prices are going to go before they get there. The main reason you want to know the major banks' forex positions is to lower your exposure to risk and to optimise the probability of entering a profitable position. Nevertheless, copying the actions of big banks doesn't guarantee perfect results.

The law of uncertainty in the currency markets means that even the big banks can sometimes lose. Also, signing up for a premium newsfeed will increase your trading costs. If you can afford it, it can increase your profits. But if you're a beginner or just started trading with low capital, it might not be so profitable.

Relying on your own fundamental research and technical analysis can also help increase the odds that you enter into high potential trades. With trend following strategies, you can always take advantage of a trend after it happens instead of trying to catch the trend before it happens. You can also use contrarian strategies to scientifically identify trend reversals before they happen.