Smart Money: the institutional trader's strategy

Institutional investors and traders buy and sell a lot of currencies. They use supply and demand to move prices. This is referred to as the "Smart Money" concept.

These professionals take positions that are opposite of you, assuming that you're one of millions of "small" traders. In the bid (buy) zone, they take large sell orders, which leads to an imbalance between supply and demand, causing the price of the currency to fall. And conversely, in the ask (sell) zone, they take large buy orders to drive up the price of the currency.

This is basically a hunt against stop orders.

The Smart Money strategy is an institutional trading strategy. It's very effective for trading with better accuracy and precision by having access to reliable knowledge and resources.

The Smart Money strategy is much better than traditional retail investor trading, which is more common but produces less effective results. This is because it involves taking advantage of market shifts and positions in a way allows you to maximise profits. This allows you to have an almost accurate prediction of price action.

This strategy involves central banks, institutional investors and market makers who together wield powerful influence in the financial markets. As a result, the smart money strategy allows you to align your trades with the power and influence of big players to increase your chances of making steady profits.

As you probably know, institutional players have positions that are so big that they can lead to major market shifts. Also, they have a deep understanding of market psychology. Moreover, they're not here to lose but to win as they have maximsed their resources to ensure continued success. If you want to succeed, you need to adopt a similar mindset.

In fact, that doesn't mean you'll never lose when using this strategy, but it will keep you focused and ready to win more consistently. Once you adopt trading strategies that are in line with those of the big players, your chances of making profits goes up.

There are two major strategies around Smart Money: order book analysis and taking advantage of traps.

Order book analysis

Order book analysis is a smart money strategy that allows you to get a clear view of the market's position. It allows you to study and asses the market sentiment of forex pairs, directly from your MT4 trading platform.

This strategy is based on the idea of ??market execution which is the opposite of general retail trading practices. Therefore, you can benefit from seeing the orders that are placed. Thanks to this, you are able to identify excessive groupings, that either exist or don't, between sellers and buyers.

The order book is designed such that the left side displays all pending orders, including stop losses and take profit orders, while the right side reveals open trades. By using the order book indicator to identify what other retail traders are doing, you can make great decisions and trade successfully against them for better profit margins. The order book indicator allows you to:

- Identify significant market levels that are likely to be targeted by financial institutions,

- Determine the likely point of the next market move,

- Identify the largest stop loss clusters.

Taking advantage of traps

Taking advantage of traps requires using the stop loss cluster indicator to look at areas where stop orders are converging. Usually they tend to converge around key highs and lows or psychological round numbers. It is important to note that the cluster simply indicates that there is a significant number of stop orders just waiting to be executed.

Armed with this knowledge, you can easily spot areas on your chart that are likely to be targeted by Smart Money, because for big players, stop-loss orders mean liquidity.

Liquidity is needed to complete a larger trade without having to experience significant price slippage when entering into such a trade. These cluster areas allow you to avoid placing your stops in areas that already contain clusters. Thus, you can effectively use Smart Money in the market in order to profit from liquidity clusters.

Understanding this Smart Money concept is a good weapon against the up and down nature of the forex. Nevertheless, you still need to be able to adapt to the different challenges that the market will throw at you.

That's why you should never dwell on a few losing trades. You must understand that it is not easy to become a good trader in the forex market with regular winning trades. You must be prepared to put in the effort while learning how the market and its different parts work. You also need to be smarter when placing your positions. This way, you'll no longer fall prey to the grand scheme of things.

Bank trading strategy: the basics and the key steps

The forex market is the world's most important financial market, with a daily volume of nearly $7 trillion. All parties, from large banks to individual traders, take part in this foreign currency market in the hope of making profits from currency fluctuations. Much of the daily volumes of this market are controlled by the larger banks. They have the power to dictate the direction in which the market moves, and when they want it to happen. It is therefore in your interest not to trade against the banks. After all, they are profitable 90% of the time, while the retail trader loses 90% of the time.

If you're a forex trader, it's key that you know who's involved in forex trading and why they are trading market. We'll therefore break down the players of the forex market before discussing the banking strategy:

Commercial banks & investment banks

Commercial and investment banks are responsible for the majority of total trading volumes. However, it is the big banks (such as Goldman Sachs, Lloyds, Citigroup, etc.) that control the interbank market with their financial power. For the record, the interbank market isn't the exclusive domain of banks. Other players like investment managers and hedge funds also fall into this category. Apart from conducting their own trades, banks also offer forex trading services to their clients by acting as dealers, earning money from the spread between bid and ask prices.

Central banks

Each country has a central bank and it plays an essential role in the foreign exchange market. It can significantly influence exchange rates through open market operations and interest rate policies. Also, some of them are responsible for pricing their currencies in the market, so they can deliberately strengthen or weaken their currencies as needed. All measures taken by central banks are aimed at stabilising or improving a country's economy.

Fund managers

Investment managers and hedge funds are the two biggest forex players after banks and central banks. Investment managers engage in currency trading for services such as pension funds, foundations, and endowments. If they have international wallets, they will have to buy and sell currencies. They can also perform speculative forex trades. On the other hand, speculation is part of the investment strategies of hedge funds in the foreign currency trading market.

Companies with an international presence

Multinational corporations whose business activities involve both the import and export of goods and services contribute are part of the forex trading landscape. Consider the following case: a French tire company imports components from Canada and sells its products in England. The profit that this company makes in pounds must be converted into euros, which are then converted into Canadian dollars to buy other components.

To minimise the risk of forex price volatility, this French company may buy CAD in the spot market, or enter into a currency swap agreement to acquire CAD in advance before buying the Canadian components. In this way, the French company reduces its exposure to currency risk.

Individual traders (you!)

Traders like you are called a retail traders, or individual traders, because you trade with your own money through a broker. The number of retail traders has grown exponentially in recent years. Around 89% of all traders are individuals like you. However, the contribution of retail traders to the forex market remains minimal compared to other market participants in terms of trading volume. Retail traders can use the combination of fundamentals and technical indicators to take on the market.

Who are the "Smart Money"?

Now that we know who each forex market participant is, there's another term that we must know: Smart Money. In general, smart money traders can be defined as the largest market participants whose capital can change market patterns. Their trading volume is so large that their positions cannot be opened or closed in a single order without prices rising. Smart Money includes large investment banks, hedge funds, massive global corporations, insurance companies, accessory companies, etc.

According to a 2020 survey, banks dominate the market share of daily forex volumes. Of the top 10 institutions on the list, eight are banks. JP Morgan leads the market, followed by UBS and XTX Markets.

- USA - JP Morgan: 10.79%

- Switzerland - UBS: 8.12%

- UK - XTX Markets: 7.59%

- Germany - Deutsche Bank: 7.57%

- USA - Citi: 5.54%

- UK - HSBC: 5.52%

- USA - Jump Trading: 5.54%

- USA - Goldman Sachs: 4.61%

- USA - State Street: 4.62%

- USA - Bank of America Merrill Lynch: 4.49%

XTX markets and Jump Trading are the only non-bank entities listed above. But like banks, these entities are also smart money that acts as a market maker. Since smart money participates in market making activity, it drives the market according to supply and demand.

What strategy do the banks use?

What the banks do is identify the most likely price levels where they can open and close positions based on supply and demand areas. As the banks control the majority of daily volumes in the forex market, when they move, the market moves. With this information in mind, we can track their trading activity and use it as a basis for the "banks' trading strategy".

The 3 key steps

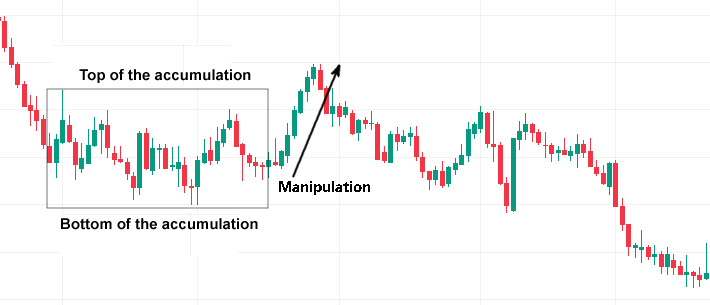

When it comes to trading the forex market, banks conduct their business in three stages: accumulation, manipulation, and market distribution/trend. Accumulation is the stage where banks enter a position, manipulation is the stage where a false push appears, distribution is the stage where a trend begins.

Before we dive into this stuff in detail, we must remember that the laws of supply and demand apply to forex trading. If you want to buy a currency, there must be someone else willing to sell it. Likewise, if you want to sell a currency, another trader must be ready to buy. Buy and sell considerations are present in each trade.

So, based on the above law, if the bank plans to buy a large position, it must find an equal amount of selling pressure. It would be easier for us to spot its trade if they entered the market in one large order. But of course, that never happens. What it does instead is place its order over time, also known as the accumulation stage. This concept is explained by Richard D. Wyckoff in his analysis of VSA volumes (Volume Spread Analysis).

1. Accumulation

Accumulation is the first step you need to identify in the banks' trading strategy. Banks either enter the market by accumulating a long position which they will later sell at a higher price, or a short position which they will later buy back at a lower price. If we can identify the precise price levels where banks are accumulating, we will also be able to identify the direction of future price movements. This is why accumulation is an essential step in the trading strategy of banks.

Unlike retail traders like you, banks have to take positions over time due to their huge trading volumes. They do this to conceal their activity, because one single huge order would send the market soaring or sinking.

To understand what the accumulation stage looks like, look at the EUR/GBP chart below. Accumulation is characterised by a ranging-type market where the price moves sideways. It is in this zone that banks regularly enter the market to accumulate their desired position over several days or hours.

2. Manipulation

Manipulation is the next step after accumulation. This stage is characterised by a false push that initiates a short-term market trend. Retail traders are often victims of such market manipulation. They take positions when they see that there is a potential rupture. But it turns out to be just a fake push and the price then moves in the opposite direction.

If you ever find yourself in this situation, it's not bad luck. The forex market isn't being unfair with you. Most likely, however, is that you are being used by the banks. What does this mean?

Let's say that the banks are trying to enter or build up a long position. At the same time, they're also creating selling pressure. They will try to "manipulate" retail traders into going short.

To follow the banks, you need to identify the false push that marks the end of an accumulation phase. How can you identify this false push or manipulation? Take a look at the bellow chart.

For a bear market, a false breakout can be identified when the price breaks the high of an accumulation period, indicating that the banks have sold on the market. After the false push, we will most likely see a short-term downtrend.

For a bull market, a false breakout can be identified when the price breaks the low of an accumulation period, indicating that the banks have been buying on the market. After the false push, we will most likely see a short-term uptrend.

3. Distribution or market trend

Distribution is the stage where one can make money in the market. At this point, the banks have accumulated their position and created market manipulation. They no longer try to conceal their presence. Now, the banks will try to push the price in a specific direction, which means this is where a market trend will begin.

Market distribution can be considered the easiest of the three steps, but this task is highly dependent on the previous two steps. It's important that you avoid the manipulation trap. If you understand how the banks have manipulated the market, you'll be able to identify the direction of the market trend that the banks are trying to push. Your next task will then be to follow the trend.