What is a DMA (Direct Market Access) broker?

The term "Direct Market Access" (DMA) is used in the financial markets to describe electronic trading systems that provide traders with the means to interact directly with the order book of a stock market.

When it comes to CFD trading, DMA refers to a type of trading that gives you direct access to the underlying market by transmitting instructions directly to an exchange. This means that there is no broker intervention and transparency is paramount. As a DMA broker offers the trader direct access to the markets, all trades are covered.

Direct Market Access is also referred to as Level 2 or L2 trading, as it provides access to comprehensive market depth data from various exchanges. Using Level 2 data, you can assess market sentiment and liquidity. DMA trading also allows you to place orders at any level and potentially within the spread when trading DMA CFDs, as well as acting as a "price maker".

DMA CFDs offer traders many of the advantages of conventional trading, but with the added benefit of leverage, i.e. margin trading.

What is level-2 data?

If you just want current prices, all you need is real-time "level-1" data. These typically display the highest bid price, lowest ask price, and available volume.

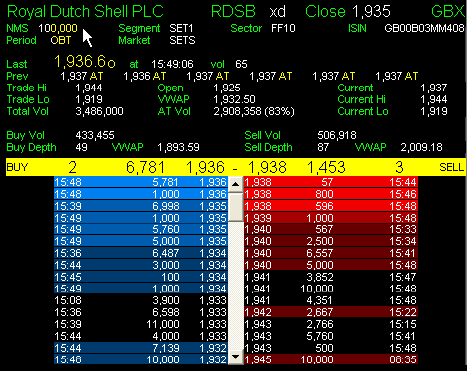

Level 2 data is much more detailed. It displays the depth of the market: the best bid and the best ask, the volumes available, but also the other best bids and asks from the stock exchange's electronic order book. So on one side of the screen you'll see a list of buy prices and on the other side you'll see the list of sell prices.

The exact number of quotes displayed varies between exchanges. Some will only show the top five positions of the order book, while others will allow you to see every single order in the order book.

The below image shows a sample Level 2 screen. On the left, side are the bids and total volume at each bid price. On the right are the bids and the total volume available at each bid price. The yellow band at the top indicates the highest bid and the lowest bid, which constitute the current market price.

DMA CFDs (Stocks)

DMA CFD trading provides you with the advantage of being able to enter or exit trades at a more favourable price, giving you an edge over traders using a market maker broker. When you place an order, it is instantly displayed on the exchange and therefore has an effect on the price of the share on which the CFD is based. This is why DMA CFD traders are called "price makers" because they have the ability to influence the market directly.

It should be noted that DMA trading is only applicable for stocks. It is ideal for highly capitalised traders who want to execute trades in the underlying market. If you want to trade currencies, commodities or indices, you'll have to use the services of a market maker CFD broker, as these CFDs are generally available for a broader range of instruments.

Benefits of DMA CFD trading

- Transparency - traders can see the market depth for each stock and the prices that other traders are willing to trade at.

- Become a price maker - by sending all DMA orders to the live market, you can impact supply and demand by exerting upward pressure when buying and downward pressure when selling.

- Better liquidity - a DMA model allows you to access the same liquidity pool as the underlying market. You can also trade in the opening and closing phases where a considerable proportion of the daily volume can be traded.

- Execution speed - a DMA model allows for less intervention between you and the underlying market, so there is no re-quoting of prices. The priority given to transparency and speed of execution ultimately benefits the trader.

- Trades within the spread - traders can place orders within the current best bid and best ask limits, when available.

- Added order features - traders can use "Fill or Kill" and "Execute and Eliminate" instructions in conjunction with limit orders and market orders.

In summary, with the DMA model, you benefit from real-time pricing, full market depth, and the ability to access the exchange's order book. In addition, it offers the possibility of leverage, low commissions and short selling, which make DMA CFDs a powerful trading tool.

Who trades using direct market access?

Direct market access is recommended for advanced traders, as it may present some difficulties. For example, you can access advanced trading strategies - such as algorithmic trading - which are more suitable for experienced traders.

Additionally, it is also suitable for those who who want to trade high volume trades due to the requirements associated with the execution of such orders.

In addition to retail traders, users also include buy-side firms, such as hedge funds, mutual funds, pension funds, and private equity funds. Buy-side firms can use the technology infrastructure provided by sell-side firms (i.e. investment banks) to gain direct market access. Many sell-side firms now provide direct-to-market services to their clients.

DMA brokers

Here is a selection of the best CFD brokers to invest in stocks with direct access to stock markets:

- XTB: 2,000 stocks and 16 ETFs commission-free up to €100,000 in monthly volume, then 0.2% commission.

- Admiral Markets: over 4,000 stocks, commissions range from 0.10% to 0.15%.

CFD trading is based on speculation and involves significant risk of loss, so it is not suitable for all investors (74-89% of retail investor accounts lose money trading CFDs).

| Previous: What is an ECN broker? | Next: Islamic brokers |