The "Grid Trading" strategy

On this page, we'll be exploring the "grid trading" strategy. Those who use this techique claim that its principles are totally contrary to what is normally taught about risk management and market trading in general, but they also claim that it works and that, if used correctly, it will generate a steady stream of profits. However, others say that it is just bogus solution that will only cause you to lose money. Below, we are going to introduce the Grid Trading concepts so that you can decide for yourself.

Grid Trading has been around for quite some time. It allows you to enter the market regardless of its direction. However, the philosophy behind this system generally goes against the principles accepted by most fund managers and traders. As we will see later, it is a system that requires discipline, patience and capital. Those who regularly use the Grid Trading strategy claim that over time they get windfall profits and have the advantage of not needing to constantly monitor the market's current trend.

This system consists of placing buy orders at regular intervals above the current market price and sell orders below the current price. Each order is configured with a Take Profit which is equal to the distance between the different levels and there is no stop loss. All these drawn lines make the table look like a grid, as shown below:

The grid is defined by a series of variables that offer a wide range of possibilities since we can configure it with an infinite number of values. Depending on these parameters, strategies that use Grid Trading can be very different from each other. Right now, we're simply going to focus mainly on the traditional version, which doesn't use a Stop Loss, and where the levels are equidistant from each other and where there is a set Take Profit associated with each trade that is equal to the distance between the various levels.

Over time, a traditional grid will accumulate unrealised losses, while the balance will increase in a linear manner. For this reason, the profitability of the Grid depends entirely on the number of times that the price of the asset crosses the various levels. So, if we have a grid with already-defined width and density of levels, there is a minimum number of level crossings that must occur for this strategy to be profitable, since the total sum of profits is to exceed the sum of the unrealised losses that are accumulating.

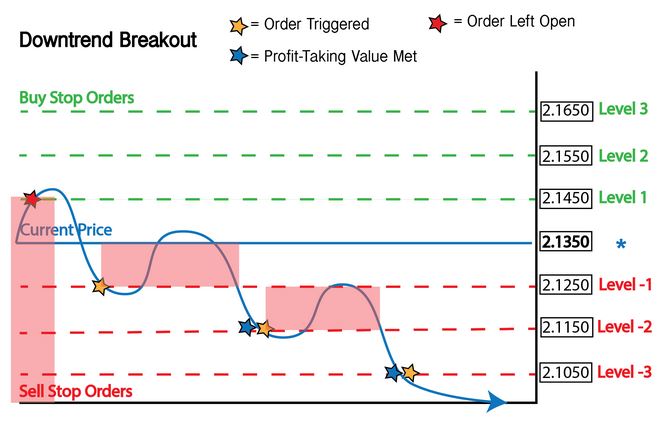

The trading strategy on this chart is represented by three levels (three above the current market price and three below the current price). The current price is 2.1350, and the trader has decided to place the orders with an interval of one hundredth of a dollar. Many investors choose to calculate support and resistance levels and use these values ??as a guide to define the intervals for their grid strategy.

The take-profit values ??for each order are one hundredth away from the entry value (equivalent to the interval) so that when one trade is closed, another one is opened at the same level.

Possible outcomes when using the Grid Trading strategy

The effectiveness of this trading strategy largely depends on price action. In a trending market, price will inevitably break out of its current support and resistance band and move in one direction for an extended period of time. In an ideal trade, the price will constantly rise or fall in one direction without a swing, hitting all of your orders and profit taking in consecutive order. The following two images show an ideal uptrend and downtrend breakout scenario.

There are 2 other possible - and imperfect - scenarios that could occur in a trending market:

- The price could go in one direction and then reverse to the other side, leaving an open position in the opposite direction.

- The price could oscillate, and open a position, but it will initially not reach your take-profit level, thereby producing a larger unrealised loss.

The losses that result from each scenario are highlighted in red in the following chart.

If you are able to identify this scenario, you can attempt to mitigate your losses by placing additional stop loss orders to exit a trade in the event that prices don't immediately shift in your favour.

In a turbulent market, it is hard to predict the effectiveness of this strategy without a thorough understanding of the market. In some markets, prices may consolidate, as shown below.

This erratic price fluctuation will open all of your entry orders and hit all of your take-profit points. In this case, it is extremely important that you monitor your net profits and losses to know when you should stop the strategy.

The benefits and drawbacks of using the Grid Trading strategy

The main benefit of Grid Trading is that this strategy eliminates the need to identify a market trend. By creating a grid of pending orders, you can walk away from your computer with the confidence that no matter what direction the price is going, you won't miss a profit opportunity. That being said, this strategy can be risky if the take profit values are not immediately reached after a position is triggered. In addition, creating a large volume of pending orders inevitably involves managing a greater number of trades. Although Grid Trading requires less manual action, it still requires constant monitoring of the market. When a trend occurs, you should close any pending orders that go against the trend. You should also watch for triggered positions to make sure that the price doesn't reverse before it has reached the take-profit level you've set (thereby leaving you vulnerable to substantial losses).

In order to create an effective grid trading strategy, it is important to understand how your market generally performs and how to manage the risk/reward ratio using your other analytical indicators.

| Previous: Elliott Waves theory | Next: The "Sure-Fire" forex hedging strategy |