Price action trading strategies

| - Inside bars |

| The Support and Resistance forex trading strategy For professional traders, the analysis of support and resistance levels is a crucial component of technical analysis. Here are a few cases where you can use a support and resistance forex trading strategy with trendlines. |

| The Price Action forex trading strategy (trading the trend) This forex trading strategy is based on price action. It will teach you how to identify the direction of a trend by looking at two different timeframes. Although it is possible to trade trends in a small timeframe, you... |

| The Pin Bar forex trading strategy The formation of a pin bar is actually a trend reversal featuring 3 bars. The term "Pin Bar" is an abbreviation of the term "Pinocchio Bar". |

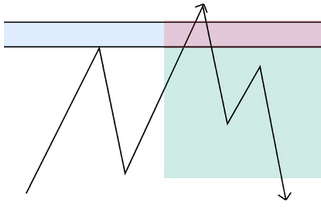

| False breaks are an indication of what institutional traders are doing: hunting the stop loss levels of small retail taders to get them out of their positions and create a price "vacuum" to reverse the market's trend. |

| How to filter good and bad Price Action entry signals One problem many traders have is distinguishing good trading signals from bad ones. Here's how to filter price action trading signals. |

| Two trading strategies: inside bars and NR4/IB The inside bar and the NR4/IB trading strategies allow you detect a high probability that a very volatile movement will occur after the breakout of a formation. |

| Price action: a random distribution of profits and losses Traders need to understand that trading outcomes follow a random distribution. |

| How to set your stop-loss and take profit targets When you trade, setting your take-profit and stop-loss levels is important in order to maximise profits and minimise losses. |

| The pending order trading strategy A trading strategy that uses pending entry orders allows a stop order to be executed with momentum confirmation and eliminates the need to sit in front of your trading platform waiting for your entry price to arrive. |

| Price action: the contrarian trading strategy The trading strategy of the pros is to simply face retail traders. They make money when other traders' speculative positions go wrong and prices reverse in the opposite direction. |

| The "Rat Reversal" forex trading strategy This strategy is a basic scalping strategy that aims to make quick gains off of the day's high or low. The rules for entry are very basic and easy to follow. Exit, on the other hand, requires you to make a judgement call and... |

| Supply and demand trading strategy for professional traders If there's an equilibrium zone in the market, is there also an imbalance zone? If so, is there a link with supply and demand trading? This is explored in the article. |

The trading strategies of professional traders

| Smart Money concept: the trading strategy of institutional traders Institutional investors and traders buy and sell a lot in the forex market. They use supply and demand to move prices. This is called the Smart Money trading strategy. |

| Bank trading strategy: how to enter a trade The strategy used by institutional traders (Smart Money) to invest in currencies. Retail traders who don't have this knowledge are at risk of always being tricked by banks. |

| How banks manipulate the market and hunt stop losses Those with deep pockets, such as banks and other large investors, are the ones who are moving and manipulate price action to obtain liquidity in the market. |

| Charles Henry Dow is considered to be one of the fathers of technical analysis. Along with Edward D. Jones, he co-founded the Wall Street Journal. With the objective of predicting the future evolution of the economy, he created the Dow Jones index, the world's oldest stock market index. Despite the significant evolution of the financial markets, Charles Dow's theory is still valid today. Nevertheless, after his death, William... |

| Volume Spread Analysis (VSA) by Richard Demille Wyckoff Richard Demille Wyckoff's method, which compares prices in relation to volume, was later expanded upon by Tom Williams. VSA is an analytical technique based on the trades of professional traders, it provides information on why and when traders are positioning themselves in the markets. |

| At the end of the 1930s, Ralph Nelson Elliott (1871-1948) published the "Wave Principle", having been inspired by Dow's theory and Italien mathematician Fibonacci's golden number. Elliott believes that the markets don't evolve in a random manner, but instead follow repeated trend cycles (up or down) that are influenced by nature and human behaviour. |

Martingale strategies

| Grid Trading is a strategy that allows traders to enter the market and make money no matter what the market's trend is. |

| The "Sure-Fire" forex hedging strategy This forex trading technique is powerful as it allows you to profit no matter which way the market is going. By identifying trending markets, your hedge will protect you (and earn profits!) even if the market changes directions. |

| Trading against the professionals The round number forex trading strategy - when used during periods of low volatility - allows regular non-professional traders to get the upper hand over professionals (banks and market makers). Following a significant... |

Tips to improve your trading strategy

| 110 systematic and discretionary trading strategies In this article, we show you various systematic and discretionary trading and investment strategies, covering a wide range of approaches, asset classes and time horizons, along with brief descriptions of each. |

| Tips to simplify your trading strategy "Simple" trading using a chart with no technical indicators is the most effective and widely used trading method. |

| Correlations can be used to avoid bad trades, like a false break and to confirm a trade or an analysis. The idea is to see if pairs with a positive correlation are moving in the same direction as the currency pair you are interested in. |

| The Dollar Index (USDX) and dollar smile theory The dollar smile theory - as described by Stephen Jen, a former currency strategist and economist at Morgan Stanley - allows traders to predict long term forex trends. |

| The Commitment of Traders report (COT report) The Commitment of Traders strategy is based on a weekly report where large institutional traders have to disclose their long and short positions. It is useful as it helps you determine when a market reversal is looming. |

| Trading economic news announcements The publication of economic statistics such as the NFP (Non-Farm Payroll) causes great volatility on the forex market. During these announcements, traders must be careful, because professionals (market makers) manipulate the market to hunt down their clients' stops. |

| Forex Tester is professional software that simulates forex trading. It allows you to develop and test your own trading strategies based on technical analysis with the use of several years of historical data. This is an excellent tool to develop your own trading strategy quickly and effectively. For advanced users, there are open interfaces to help you create your own indicators and strategies. |