You are not logged in.

#1 06-07-2023 14:25:17

- johnedward

- Admin & Trader

- From: Paris - France

- Registered: 21-12-2009

- Posts: 3790

- Website

How to trade using pin bars with long wicks

How to trade using pin bars with long wicks

Among the multitude of trading techniques, one candlestick pattern in particular has caught the eye due to its ability to signal market reversals and extensions with remarkable accuracy: the long wick Pin Bar.

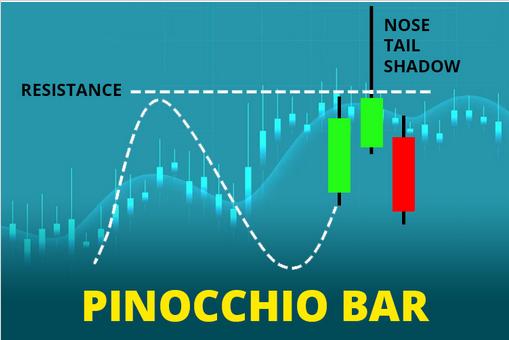

The long wick Pin Bar, often referred to as a hammer candlestick or pinocchio bar, is a powerful formation that can provide valuable insight into market sentiment and price action. Its distinctive structure, characterized by a small body and long wick, holds key information about the battle between buyers and sellers, providing traders with an opportunity to capitalize on favorable market conditions.

In this article, we will learn 2 ways to trade with pin bars such as:

The pin bars against the trend with confluence.

The pin bars against the trend with confluence.

Pin bars with trend and confluence.

Pin bars with trend and confluence.

1. Countertrend Long Wick Pin Bar with Confluence

Countertrend long wick pin bars, by their very nature, tend to form against the prevailing trend or following a significant price movement. These bars often provide interesting trading opportunities, especially when supported by confluence factors.

When analysing countertrend long wick pin bars, it is important to look for specific confluences that bolster their validity. One such factor is the protrusion of the bar wick through key levels, especially within a clearly defined range. This protrusion signifies a rejection of the price at these levels and reinforces the countertrend signal.

Additionally, a false breakout of a level, when the wick extends beyond a level and rapidly reverses, can also serve as a strong confluence for countertrend pin bars.

These confluences act as confirmation signals, indicating that market participants have reached a point of exhaustion after a sustained move in one direction. The formation of a long-wicked pin bar in such situations can be seen as the market “putting a stop” to excessive and rapid price movement.

To better illustrate this phenomenon, consider the example below, where a major reversal occurs after an extended uptrend, and a Pin Bar forms. This bar serves as a clear signal of a potential trend reversal, supported by the confluence of the pin bar's protrusion through key levels or false breakouts.

2. Long Hair Pin Bar with Trend and Confluence

Long wick pin bars are of great importance as trend continuation signals. These bars can be observed in two specific scenarios:

After a pullback within a dominant trend, or

After a pullback within a dominant trend, or

Close to key swing points.

Close to key swing points.

When a pin bar forms after a pullback within a trend, it suggests that the prevailing trend is likely to continue. This indicates that market participants rejected the lower (in an uptrend) or higher (in a downtrend) prices during the pullback, reaffirming the strength of the underlying trend.

Traders can use this signal to initiate trades in the direction of the trend, capitalizing on the anticipated continuation of price movement.

However, it is essential to exercise caution when large bars form near the top or levels of a trend. These scenarios can potentially signal an impending collapse or trend reversal. These large bars can indicate significant price rejection at extreme levels, suggesting market sentiment is changing.

Traders should approach these situations with trend confirmation indicators or reversal patterns before making trading decisions.

"Anything worth having is worth going for - all the way." - J.R. Ewing

Offline