Pending order trading strategy (using buy stops and sell stops)

The market offers a bountiful amount of trading opportunities each month, but we don't always have the time or patience to sit and stare at our charts waiting for the market to reach our pre-determined entry level.

Also, sitting around waiting for the market to trigger an entry is a big fat waste of time and can tempt you into entering a trade prematurely or entering a trade that you otherwise could not have made.

Fortunately, by knowing how to use pending entry orders, you can eliminate the need to sit at your trading terminal waiting for the market to trigger an entry.

Benefits of using Stop loss orders

Let's see how stop entry orders can improve your trading and what their main benefits are:

Confirmation of momentum - When you enter the market using a stop entry order, the market is moving into your order in the direction you want to trade. This has the added benefit that the price is already moving in the direction you are trading at the time of entry and often allows your trade to quickly become profitable. If you use the other two popular entry orders, namely market entry or limit entry, you don't necessarily get this.

For example, if you enter a buy stop order, that means you're buying the market, and for your buy stop order to be filled, the market must be rising and entering your buy stop order, which means it has bullish momentum. Conversely, if you enter a "sell stop" entry, the market has to move down towards your sell order. This does not "guarantee" that the trade will go through in your favour, but when your order is triggered the market is moving in your favour.

You don't need to be at your computer - Stop entry order allows you to set your trade and forget about it. Also, unlike entry limit orders, with a stop entry order you have peace of mind knowing that if your trade is executed after you set it, it will be executed with "momentum confirmation", as we have mentioned above.

Many of us don't extra hours to wait for the market to move towards our desired entry level. If you use a pending entry order, you don't have to sit around watching and waiting; once you spot a trade setup, you can simply enter your stop entry order, your stop loss level and your profit target and then leave for a while.

Eliminate trading obsession - If you're trading an inside bar setup, for example, you don't need to wait for the market to break above the high or low of the mother bar to enter. Instead, you can simply place a stop buy or stop sell order just above the high or low of the inside bar and then go do something else. Traders who are obsessed with trades and glued to their screens tend to lose money, you need to be interested and passionate about trading but not obsessed with it.

Reinforce discipline - If you set an entry stop order and then walk away and let the trade play out, you are trading with discipline. There's something to be said for "letting the market come to you", rather than continually throwing in "market" orders. An entry stop order allows you to set the exact level at which you want to enter; if the market exceeds a certain level, you will be filled, otherwise, you will not. Many traders enter trades too early, before they really start to move, and this causes them all sorts of psychological problems like questioning their entry, over-analysing and closing trades prematurely; if you enter with a stop order when the market is moving towards your desired entry level, this can help eliminate mistakes.

Also, by setting your order and then leaving your screen, letting the market "do the work", you get into the habit of not "forcing" trades and trading in a relaxed way, instead of over-trading or entering prematurely. When you start to have success trading this way, this will reinforce the discipline you have in terms of placing your order and walking away.

Examples of effective buy/sell stop entry orders

Using stop entries to enter the market along with new market momentum is very interesting. The idea is this: after momentum that is opposite of the recent trend, a stop entry on a price action signal can help "confirm" that the new momentum will continue at least for some time after your trade entry order is executed.

In the below forex pair chart, we see a sell signal on a pin bar that formed shortly after a downward market move that was following a strong upward trend. The most logical entry order on this sell signal is a "sell stop", as it gives us additional "confirmation" (not 100%) that a bearish momentum might be underway. In this case, the pin bar signal actually kicked off a very large downward move and formed very early in the new downtrend.

Using stop entry orders can help you enter new trends early. By entering the market in line with the short-term momentum, you get a little extra "confirmation" that the trade you are entering into is more than just a temporary countertrend retracement:

The stop entry is the only type of entry to use for an inside bar setup strategy. An inside bar setup is by definition a breakout game, so you need to get in line with momentum waiting for price to break above or below the parent bar's high or low.

In the below chart, we can see an inside bar setup. Note that using the sell-stop entry gave us a little extra "confirmation" that the downtrend might continue by getting us into the trade when the bearish momentum pushed the price down on our stop entry placed below the low of the pattern's parent bar:

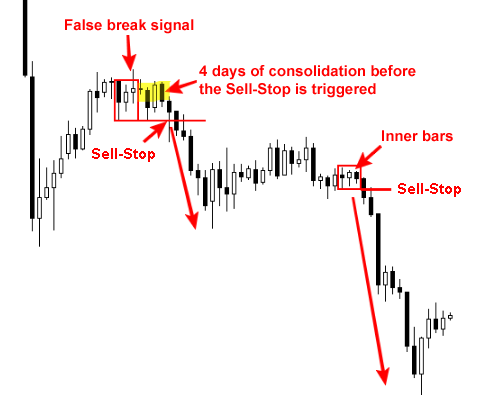

In the below chart, we observe two sell signals in the gold market that you could have entered with stop loss orders. The first is a false sell signal. Notice how the market consolidated and "cut" sideways for a few days after the signal formed. If you had placed a sell stop order just below the low of the false bar's parent bar, you wouldn't have been filled until the price finally fell, triggering the false bar's sell entry 5 days further. If you had entered "at the market" or on a boundary retracement entry before the price broke the low of the parent bar, you would have had to endure a few days of sideways price swings, including one day of strong upside against your position. Many traders struggle to deal with the emotions they feel when they enter a trade prematurely like this and have to wait for it to complete, and they end up closing trades prematurely for no real reason, then the transaction ends without them being on board; this can be avoided by using stop entry orders as we'll see here:

Note: although the previous examples illustrate "sell-stop" orders, "buy-stop" ones work just as well and the same logic applies.

How to place a pending stop order

Let's take a quick look at how to place pending stop orders on the Meta Trader 5 trading platform:

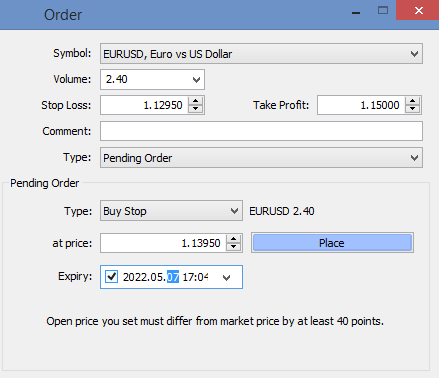

Step 1: there are several easy ways to open the order entry screen in MT5. The first is to right-click on the market chart, then hover your mouse over "trading" and then "new order", click on it and you should see a box appear. Or, you can also simply press the "F9" key on your computer when MT5 is running, which will also open the order entry window. Or, you can go to "Tools" at the top of the platform, then select "new order".

Step 2: the next step is to select "Pending Order" from the "Type" drop-down menu. Then you select Buy Stop or Sell Stop, depending on the direction you're trading (Buy Stop for longs, Sell Stop for shorts).

Step 3: next, you need to select the price at which you want to enter the market and the expiration date of the entry order (if the market hasn't executed your order by this date, the order will automatically cancel out. You also need to specify what volume you are going to trade (lot size) and indicate your stop loss and profit target levels. To learn more, see this article on placing stop losses and targets.

After placing your buy- or sell-stop order, you can see it in the "Terminal" window at the bottom of your trading platform. Be sure to set an "expiration", as explained above, or cancel your pending entry stop order if it doesn't get executed on your desired date. If you miss a pending order with no expiry, you risk entering the market when you don't expect or want to, which obviously can lead to unexpected losses.

A few final words

We hope the above article opened your eyes to some of the perks of using pending entry orders and some new concepts in the MetaTrader 5 trading platform. All of the "order strategies" discussed above can be tested for free on a demo account. This powerful yet simple technology is a genuine tool you should take advantage of.