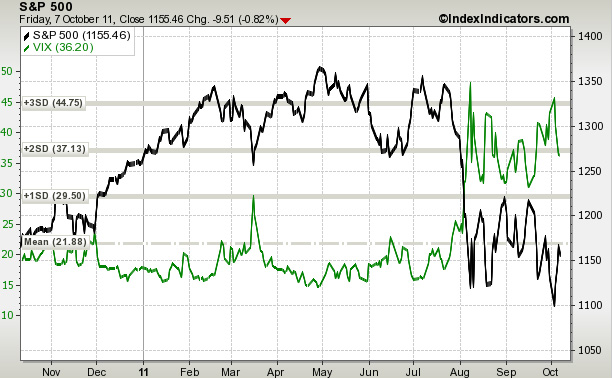

The VIX: Volatility index indicator

In 1993, the Chicago Board Options Exchange (CBOE) introduced the VIX index to measure market expectations and short-term volatility in relation to the S&P 100 and options prices. Since then, the VIX index (often called the fear index) is considered a leading barometer for assessing investor sentiment and the volatility of U.S. markets.

Ten years later, in 2003, in a joint effort between the CBOE and Goldman Sachs, the calculation of the VIX is updated in order to measure the expected 30-day volatility differently. It is now based on the American S&P 500 index (SPXSM) which is the benchmark for U.S. equities. The expected volatility estimate is calculated using the weighted average of the S&P 500's call and put options. This new methodology, which replicates a portfolio of SPX options' exposure to volatility, has become a standard trading practice in the financial markets and forex market.

On March 24, 2004, the CBOE introduced the first futures contract based on the VIX index that can be traded in the market. Two years later, in February 2006, the CBOE launched options based on the VIX index. In less than five years, the trading of options and futures based on the VIX index has reached more than 100,000 contracts per day.

When the VIX index level is high, the stock markets are unstable, nervous and very volatile. The most important thing is not the level of the index, but its variation. The markets are pessimistic when the index rises and vice versa, they are optimistic when it decreases.

Sites where you can see the VIX index indicator:![]() www.indexindicators.com

www.indexindicators.com![]() www.bloomberg.com

www.bloomberg.com