The correlation between forex, oil and gold

To anticipate forex price fluctuations, professional currency traders take a look at what's going on beyond the world of currencies. Exchange rates are influenced by many factors - supply and demand, politics, interest rates, economic growth, etc. Some currencies are highly correlated with commodity prices, as economic growth and exports are directly related to the counrty's domestic industry.

The three main currencies that are correlated with commodities are the Australian dollar, the Canadian dollar and the New Zealand dollar. The Swiss franc and the Japanese yen are also correlated with commodity prices, but the link is not as strong. Forex traders can therefore analyze these correlations to understand and anticipate foreign exchange market movements.

In this article, we will examine currencies that are correlated with oil and gold in order to show you how to use this information in your trading.

The correlation between oil and the Canadian dollar

In recent years, the price of a barrel of oil has varied considerably, it went from $60 a barrel in 2006 to a peak of $147 in 2008 before dropping below $40 dollars in the first quarter of 2009; as of April 2013, the price was back up to $88. This high volatility can also be observed in the price of gold, which rose from $692 an ounce in October 2008 to $1,896 in September 2011, but then dropped back down to $1,400 in April 2013.

As of this writing, many countries are experiencing a recession and the evolution of commodity prices can mean the difference between a deep recession and a fast recovery. Exchange rates are influenced by the prices of commodities, so forex traders should monitor their prices in order to make more informed forex trading decisions.

Oil is a commodity all over the world - at least for now - as most developed countries cannot survive without oil. In February 2009, the price of oil was 70% lower than its peak of $147 in July 2008. A drop in oil prices is a nightmare for oil producers, but for oil consumers it represents greater purchasing power.

There are a number of reasons which explain the fall of oil prices, the rise in the dollar (oil is priced in dollars) and the decline in global demand. Canada is a major exporter of oil, it is therefore severely affected by lower oil prices, while Japan, which is a major importer of oil, tends to benefit from this sort of situation.

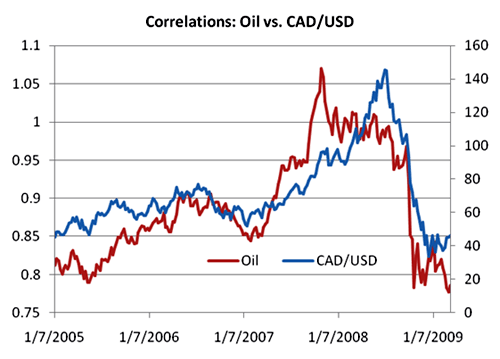

Between the years 2006-2009, the correlation between the Canadian dollar and the price of oil was around 80%. On a daily basis, the correlation is not always as tight, but it increases in the long term, because the Canadian dollar has good reason to be sensitive to oil prices. Canada is the seventh largest producer of crude oil in the world, and its oil production is steadily increasing. In 2000, imports of oil from Canada to the U.S. exceeded those of Saudi Arabia. The latest oil reserve estimates by country rank Canada second only to Saudi Arabia. The geographical proximity between the United States and Canada, in addition to the growing political instability in the Middle East and in South America, have made Canada one of the best places from which the U.S. can import oil. But Canada does not only serve the United States, the country's vast oil resources are now starting to generate lots of attention in China, especially since the discovery of new oil fields in Canada.

The below chart clearly shows the positive relationship between oil and the loonie (Canadian dollar). The price of oil is in fact a leading indicator of CAD/USD price action.

The currency pair for forex trading is the USD/CAD, the correlation is therefore inverted. It is important to note that based on its historical relationship, when oil prices rise, the USD/CAD falls and vice versa: when the price of oil goes down, the USD/CAD rises.

The Canadian economy is highly dependent on its exports, and 85% of its exports go to the United States. For this reason, the USD/CAD can be greatly affected by how American consumers react to changes in oil prices.

When U.S. demand increases, the price of oil rises and the price of the USD/CAD goes down.

When the U.S. demand falls, the price of oil decreases and the USD/CAD price rises.

Oil and the Japanese economy

Japan imports almost all of its oil (the United States imports about 50%), and it is the world's third largest oil importer after the United States and China. Japan is especially sensitive to changes in oil prices due to its lack of domestic energy resources and the need to import large quantities of oil, natural gas and other energy resources. In 2008, the country's dependence for energy imports stood at 84%. Oil provides 49% of Japan's energy needs, coal accounts for 20%, nuclear energy 13%, natural gas 14%, hydroelectric power 3% and renewable sources just 1%. Therefore, when oil prices soar, the Japanese economy suffers.

By analyzing the countries which export/import the most oil, the leading currency pair for which we can formulate an opinion on the price of oil is the Canadian dollar in relation to the Japanese yen (USD/JPY). The below chart illustrates the close correlation between the price of oil and the CAD/JPY. The price of oil can be seen as a leading indicator (like the USD/CAD pair) of the USD/JPY's price action, with a visible lag. The below chart shows that the price of oil continued to decline during this period, the CAD/JPY then shot past the 100 level and hit a low of 76.

The correlation between gold and the forex

Australia is the third largest producer of gold, and the Australian dollar has a positive correlation with gold (84% correlation on average). In theory, when the price of an ounce of gold rises, the Australian dollar also goes up.

The Swiss currency also has a strong link with gold. When the price of gold rises, the USD/CHF goes down and vice versa, when the price of gold falls, the pair also falls. The Swiss franc is strongly correlated with gold, because more than 25% of the Swiss currency is backed by gold reserves.

Conclusion

Slightly delayed correlations of these movements on the currency and commodity markets sometimes provide traders with good opportunities to anticipate a larger movement.