Double (or triple) tops (or bottoms)

These chart patterns suggest a weak trend or a reversal of forex prices. in the forex or overturning. Gradually, as the pattern is formed, transaction volumes progressively decrease. A double or triple top configuration provides gives a good signal to close a long position and vice versa for the double or triple bottom, which provides a signal to close a short position. Pullbacks and throwback are common after a break through the confirmation line. Forex traders can also initiate a short position when the confirmation line has been broken through to bet on a trend reversal, with a stop placed above the previous top.

Double and triple tops develop in an uptrend, they consist of two or three price peaks at the same approximate level.

The double or triple bottoms, on the other hand, develop in downtrends.

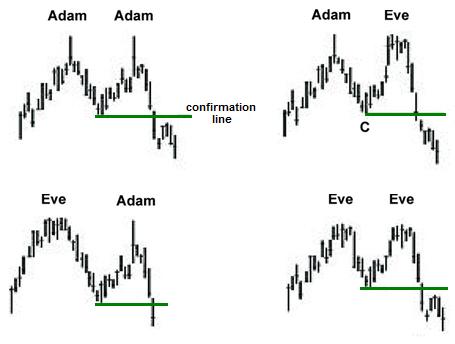

There are two types of tops and bottoms: the rounded "Eve" shapes, and "Adam" shapes, which consist of a single candlestick or peak.